The team have been incredibly supportive and pro-active and the linked insurance package offers extra reassurance (without numerous exclusions or caveats). They are experienced and always willing to discuss context and find the right solution for each situation without being overly risk averse.

The changes were due to be implemented in April 2020 but, on the evening of 17 March 2020, the Government announced the decision to delay the implementation of the IR35 changes in the private sector by one year to 6 April 2021.

It is now time to act on IR35. Read on to find out how IR35 will impact on you and how our advice and Toolkit can help.

Employment Partner Paul Scope, explains all you need to know. Paul hosted an hour long webinar on Thursday 4th February via Zoom with expert colleagues Roisin Patton, Peter Byrne and Rachel Blythe, to talk you through how this change will impact you, whether you are a business, contractor or agency. You can watch the video below.

If you prefer, you can listen to our podcast from 2020 (before the changes were delayed) featuring Paul Scope and our friends at MHA Tait Walker and Nigel Wright, explaining all your need to know about the new IR35 rules, using the links below:

IR35 legislation dates back to the year 2000 and hit contractors working predominantly in the IT, banking and public sectors. It aims to ensure that HMRC collects tax from those people who are essentially ‘employees’ disguised as limited companies for tax reasons.

Since then, the legislation has placed the onus on the individual contractor to determine their employment status – but in reality, many contractors either don’t realise or have chosen to ignore the rules.

Changes to the legislation mean that from April 2021, in the private sector it will be the responsibility of the end-user client – and in some cases recruitment companies – to ensure that contractors are compliant with IR35 legislation. Those businesses who aren’t compliant with the new rules could face large tax bills and penalties. Changes to IR35 legislation in 2017 already placed this obligation on public sector bodies.

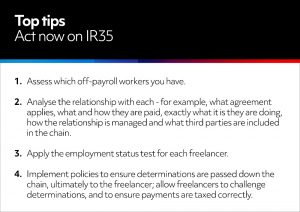

Q. What are your top tips for businesses, agencies and contractors who think they may be affected by this?

End users, agencies and contractors should act now:

Q. Where can we get help?

We have developed a toolkit to assist with compliance. The Toolkit contains a specimen contract; detailed guidance; step by step guides and flowcharts; details of the factors to take into account for the status determination test; procedures for challenging the determination; and standard letters for the process. Please contact Paul for further information on the Toolkit, which contains:

- Detailed guidance in the form of Key Facts

- Employment status checklist

- Employment status assessment flowchart

- Status questionnaire and guidance

- Letter confirming self-employed status (agency)

- Letter confirming employed status (agency)

- Letter confirming self-employed status (direct with PSC)

- Letter confirming employed status (direct with PSC)

- Status disagreement process guidance

- Status disagreement process flowchart

- Letter confirming outcome of status disagreement process

- Consultancy agreement

Q. Where can we get further information?

We have developed FAQs to give you a better understanding of IR35 which can be accessed on our Hub by clicking here.

To talk to Paul about how Ward Hadaway could help with your People needs, call him on 0330 137 3167 or 07540 556 295 or email paul.scope@wardhadaway.com. Find him on Linkedin here and on Twitter at @paulscope.