HR Protect

5th November, 2019

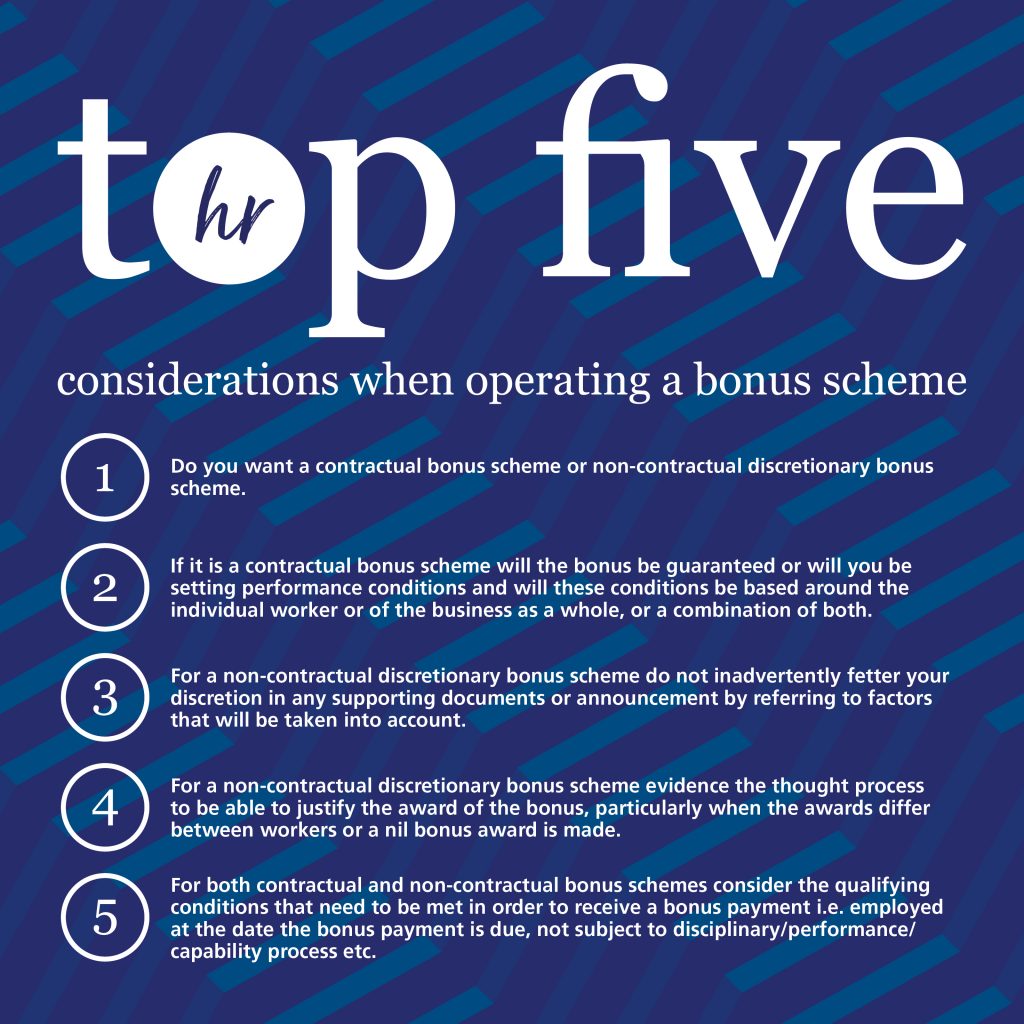

Many companies operate a bonus scheme and use them to attract and retain the best and brightest talent. But bonus awards are not always as straightforward as they seem, and it’s important to protect your business when workers dispute their right to a bonus. Our Head of Employment law, Harmajinder Hayre, takes a look at the issue.

Increasingly, I am being asked to provide legal advice on bonus payment disputes. Typically, the employer has awarded no bonus or a bonus that is far less than the worker expected. In almost every instance, the employers position has been that the bonus scheme is non-contractual, or it has absolute discretion to decide how much, if any, bonus to award the worker.

Helpfully, there are circumstances when you can correctly award no bonus. Too often though, the employer gets it wrong, giving rise to a dispute.

Awarding no bonus often undermines the rationale for the bonus scheme being introduced in the first place, and can result in significant time and cost. Employers end up dealing with internal grievances and responding to detailed requests for information about the decision making rationale and process. Often, this results in a breakdown in the employment relationship, with the inevitable risk of constructive dismissal, breach of contract and unlawful deduction of wages claims.

To answer the question of whether you have to pay a bonus, you need to go back to the bonus scheme wording and consider what the rules say. This is often where the root of the dispute can be traced back to.

Despite its importance, the wording of the bonus scheme is sometimes ambiguous, and the decision making can be opaque.

Your bonus scheme: Contractual or non-contractual?

The starting point in determining whether a bonus is payable, is to determine whether the bonus is contractual or non-contractual. In practice this is not always clear cut. For example, a scheme may give the worker a contractual right to be considered for a bonus, but provide that the amount is discretionary.

The contractual bonus

This could be an entitlement to participate in a bonus scheme, or to a certain amount of bonus, based on a formula.

In my experience, loosely worded bonus statements, agreed to incentivise recruitment, can lead to costly mistakes for the employer down the line.

In two matters that I advised on, the bonus wording was conditional on performance levels being met and was drafted by the manager recruiting the individual, to reflect what was agreed during the recruitment process.

The performance conditions were solely based on sales generated. In both cases, the individuals delivered exceptional levels of sales, far above either parties expectation from a total reward perspective. Once the employer realised the level of the bonus payment that it was exposed to, it sought to reduce the amount, by adding in caveats. Unsurprisingly, given that the qualifying performance conditions had been met, the individuals refused to agree to the caveats and the employer was legally obliged to pay the full bonuses.

Even where the bonus scheme is expressed as contractual and linked to performance conditions, you can still retain some discretion in determining whether the performance conditions have been met, so long as you act genuinely and legitimately.

The key is to make sure you address this discretion in the drafting of the bonus clause. In the matter I advised on, had the employer at the outset expressly included additional performance conditions such as net/gross margins or placed an overall maximum cap on the amount of bonus, then this would have significantly lowered the bonus payment due. Importantly the worker’s expectations would have been managed from the outset.

The contractual bonus and oral representations

It’s not uncommon for workers to assert that certain promises or assurances have been made to them before, or after, the contractual bonus clause has been agreed. For instance, part way through the year, a manager may give the worker an indication of the amount of bonus they may receive, which does not materialise. Or discussions are had at a pay review or an appraisal meeting about the level of the bonus payment, which management subsequently reject.

In such circumstances, it will be a question of fact whether the promise or assurance was made and whether this binds the employer. What you will need to assess is whether there was a genuine intention to create legal relations and certainty of terms existed. To avoid these types of disputes, I’d recommend that you include in the bonus scheme or clause that oral representations are not binding and that the terms may only be agreed or varied by writing.

The non-contractual bonus

A non-contractual bonus scheme will expressly state that there is no right to a bonus. Any bonus payments will be made at the employer’s discretion, often on conditions that it determines. The objective is for the employer to retain flexibility around having to implement a bonus scheme, the terms that make up the bonus scheme or to make any bonus payments.

The majority of non-contractual bonus schemes, even though they may be expressed as being at the absolute discretion of the employer, are only partially discretionary. The key point is that the exercise of discretion is not unfettered.

This will involve you being able to show the following:

- That you exercised the discretion honestly and in good faith

- That you do not exercise the discretion in an arbitrary, capricious or irrational manner; and

- That you do not breach the implied term of trust and confidence.

Case study

An example of how the exercise of discretion can work in practice can be seen from a bonus claim that I dealt with recently.

The employer operated a bonus scheme that it considered to be non-contractual and at their discretion. They awarded a nil bonus payment to one of their workers, who had resigned and left the business before the bonus payment date.

The employer had in place a bonus approval process that was subject to strict moderation. They had consciously decided not to communicate to the workforce the factors it took into account when exercising its discretion, or set out for those involved in the moderation process, the type of factors it should or should not take into account.

The only written reference to a bonus payment was contained in the worker’s contract, and it was expressly stated to be non-contractual and that any payment was at the absolute discretion of the employer.

The worker argued that he was entitled to a bonus because he had been employed for the full bonus year – the bonus payment date being a date beyond the end of the bonus year. He had met his appraisal objectives and was aware of other workers who had left before the bonus payment date and still received a bonus payment.

The employer had not specified any conditions within the bonus clause regarding entitlement to a bonus and had not limited itself to factors that it would take into account when exercising discretion.

Crucially, the employer was able to show by way of contemporaneous documentation and witness evidence concerning the bonus exercise for the year in question and past years, that the worker had been considered for a bonus. Also, where there was a difference in treatment between the worker and named comparators.

They were able to prove that there had been sound commercial business reasons for the difference in treatment, to overcome any allegation of the employer not exercising its discretion in an appropriate manner.

You can exercise discretion to award no bonus and treat workers differently. It will generally be more difficult for you to justify no bonus than to justify some level of bonus. You do not need to show that you acted reasonably, but you do have to demonstrate that you carried out a meaningful and rational analysis of the worker’s entitlement.

Written guidance

You may consider whether to have written guidance, setting out what you take into account when exercising discretion. You may choose to share that guidance with the wider workforce, or only those responsible for being involved in the bonus decision making process.

Ultimately, it will depend on the level of transparency you want to give to the workforce around how bonus payments are awarded. Transparent bonus schemes put you in a far better position to objectively justify your bonus decisions.

You may consider that keeping your bonus scheme process under wraps is a risk worth taking, to preserve maximum flexibility around what you can and cannot take into account. If you do adopt this approach then make sure that your bonus policy is properly drafted, to provide for this level of flexibility, and that you can evidentially justify the exercise of your discretion during the bonus payment exercise, if you are challenged.

To obtain a FREE copy of our legally compliant bonus scheme wording that provides you with absolute discretion and maximum flexibility in determining how much, if any, bonus to award a worker, please fill in your contact details.

Please note that this briefing is designed to be informative, not advisory and represents our understanding of English law and practice as at the date indicated. We would always recommend that you should seek specific guidance on any particular legal issue.

This page may contain links that direct you to third party websites. We have no control over and are not responsible for the content, use by you or availability of those third party websites, for any products or services you buy through those sites or for the treatment of any personal information you provide to the third party.

Topics: